Increased weight gain as a consequence of virus infection is not a new phenomenon. To date eight different viruses have been shown to cause weight gain in animals or humans. These ‘obesogenic’ animal viruses include canine distemper virus (in mice), Rous-associated virus type 7 (chickens), borna disease virus (rats), and avian adenovirus (chickens).

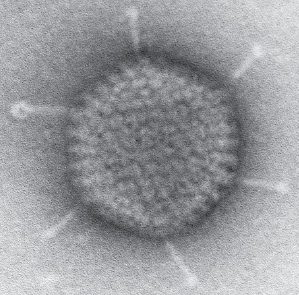

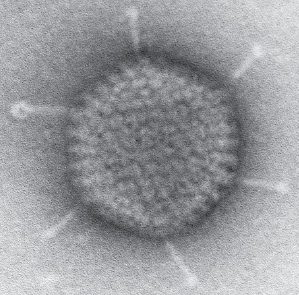

The paper which triggered the discussion this week concerns adenovirus type 36, which was first isolated in 1978 from a young girl with enteric illness. Adenovirus virions are made of a double-stranded DNA genome encapsidated in a non-enveloped, icosahedral protein shell. There are 52 human adenovirus serotypes which cause respiratory infections (common cold), enteric disease, and eye infections (conjunctivitis). Ad36 has been shown to caused increased body weight in laboratory chickens, mice, rats, rhesus monkeys, and marmosets. Three other adenovirus serotypes have been examined in the context of body weight; Ad37 infection caused weight gain in chickens, while types 2 and 31 did not.

Antibodies to Ad36 have been measured in humans to determine whether infection is associated with weight gain. In one study conducted in 3 US cities, antibodies to Ad36 were found in 30% of obese individuals and 11% of lean individuals. No difference in body mass index or serum lipids was observed when antibodies to Ad2, Ad31, or Ad37 were measured.

Ad36 induces cultured murine preadipocytes to differentiate into mature adipocytes. It has been suggested that the viral E4orf1 gene product correlates with the adipogenic effect. In the paper published in Obesity this week, the authors show that in cell culture, Ad36 but not Ad2 increases the expression of early, intermediate, and late genes of the adipogenic cascade. When an antiviral agent was used to decrease Ad36 mRNA levels, differentiation of the cells into adipocytes was also decreased. Lacking, however, are the results of experiments in which E4orf1 mRNA expression was silenced by siRNA.

Based on the information in the research literature, it is not unreasonable to postulate that Ad36 plays a role in adipogenesis. Whether the virus is a factor in human obesity remains to be determined. There are many unanswered questions. Is the weight in crease observed in animals infected with Ad36 reversible? Where does the virus replicate during the period of weight gain? When virus is cleared, does weight return to pre-infection levels? If not, why not? Before proceeding any further with human studies, it will be necessary to definitively identify the adenovirus gene product(s) that induces adipogenesis. The mechanism by which the viral protein produces this effect should be discerned. The viral gene identified should then be used to induce weight gain in animals. Should these experiments provide a mechanism for Ad36 induced adipogenesis, then more extensive epidemiological studies in humans are warranted.

Conclusion: It is incorrect to conclude that infection with a common cold virus will cause weight gain. However, the effects of Ad36 observed to date are curious and deserve further investigation in different laboratories.

Rathod, M., Rogers, P., Vangipuram, S., McAllister, E., & Dhurandhar, N. (2009). Adipogenic Cascade Can Be Induced Without Adipogenic Media by a Human Adenovirus Obesity, 17 (4), 657-664 DOI: 10.1038/oby.2008.630

Atkinson, R. (2007). Viruses as an Etiology of Obesity Mayo Clinic Proceedings, 82 (10), 1192-1198 DOI: 10.4065/82.10.1192

Pingback: TWiV 18: Can a virus make you fat?

Pingback: SCIENCEPODCASTERS.ORG » This Week in Virology #18: Can a virus make you fat?

What about the fact that fat cells, once created, tend to remain? (Or so I've read.) Even if they diminish in size, would this not result in at least some persistent increase in weight?

Good questions.

The first question – no one has done the experiment of having the virus cleared and then determining if the weight gain is lost. In most of the studies the animals (rats, hamsters, chickens) are sacrificed after so many weeks to measure body fat. In the one experiment using monkeys, weight gain was measured 18 months after infection only. It wasn't determined if the virus was still present. So many important questions remain.

Second question – you are correct, the fat cells remain after losing weight. But they barely contribute to your weight. The problem is they can rapidly return to a large size if eating increases, so their presence is a problem.

Adenovirus may cause multiplication of fat cells, but something has to fill them.

Thank you. 🙂 These matters really are fascinating!

(BTW, only the “second” question was mine…the first was actually an attempt at using blockquote to paste in questions you yourself asked, in order to tack my question onto them. I only mention this to point out that the blockquote function is indeed subtle with this program…at least on my monitor…all I see is a lighter-colored font, which would be easy to miss entirely, if I didn't know it was supposed to be there…)

I always visit Burn Fat Belly for weight loss tips and secrets. Some relevant informations there, they get experts to write for them.

Catastrophe Eastern

von Raivo Pommer-Eesti-raimo1@hot.ee

Eastern Europe’s woes are not unmanageable. But they are not being managed. The result could be catastrophe

AMID the wreckage of Latvia’s retailing industry, which has declined 17% year on year according to the latest figures, one item is selling well: T-shirts with seemingly mysterious slogans such as “Nasing spesalâ€. Latvians are glad to have something to laugh about, even if it is only their finance minister, Atis Slakteris. In an ill-judged foreign television interview, using heavily accented and idiosyncratic English worthy of the film character Borat, he described his country’s economic problems as “nothing specialâ€.

Put mildly, that was an original interpretation. Fuelled by reckless bank lending, particularly in construction and consumer loans, Latvia had enjoyed a colossal boom, with double-digit economic growth and a current-account deficit that peaked at over 20% of GDP. Conventional wisdom would have suggested applying the brakes hard, by tightening the budget and curbing borrowing. But the country’s rulers, a lightweight lot with close ties to business, rejected that. Fast economic growth made voters feel that European Union membership was at last producing practical benefits, after a disappointing start when tens of thousands of Latvians went abroad in search of work, leaving rural villages and small towns depopulated.

Click here

The central assumption, in Latvia and many other countries in or near the EU, was that convergence with rich Europe’s living standards and other comforts was inevitable. Lending in foreign currency went from 60% of the total in 2004 to 90% in 2008. Why pay high interest rates in the local currency, the lat, when the cost of a euro loan was so much cheaper? In a few years Latvia would surely join the euro anyway. Similarly, worries about financing the inflows were dismissed: Swedish banks would no more abandon their subsidiaries in Latvia than they would pull out of, say, southern Sweden.

Last year tested those assumptions nearly to breaking point. First, Latvia’s housing bubble popped. Then the main locally owned bank, Parex, went bust and had to be nationalised, amid fears that it could not pay two syndicated loans due this year. In December Latvia accepted a humiliating €7.5 billion ($9.56 billion) bail-out led by the IMF.

The big cuts in social spending that the package entailed led to vigorous public protests. Now the government has resigned. At a time when strong leadership and public trust are needed more than ever, the country’s squabbling and discredited politicians look hopelessly out of their depth. Latvia is an economic pipsqueak, with just 2.4m people. But the rest of the region is watching nervously, fearful that more bad news from the Baltics could bring others crashing down too.

It is easy to be pessimistic. This is indeed the worst economic crisis since the collapse of the communist planned economies and the wrenching process of privatisation, liberalisation and stabilisation that followed. The main ex-communist economies are likely to contract by 3% this year, according to Capital Economics, a consultancy. Yet the picture is not uniform. Only a few countries have needed an IMF bail-out. One is Latvia, whose economy is set to contract by at least 12% this year, and whose credit rating has just been downgraded by Standard & Poor’s to junk. Another is Hungary, burdened with a larger debt-to-GDP ratio than almost any other new EU member. It received $25 billion in October and faces a contraction of up to 6%. A third is Ukraine—chaotically run, corrupt and badly hit by the slowdown in its main export market, Russia. Ukraine’s IMF deal brought it $4.5 billion in November. But a second tranche of $1.9 billion is stuck; the deal is unravelling as politicians squabble over spending cuts. Its economy is likely to shrink by 10% this year. Other countries with IMF packages agreed or pending include Belarus (a Russian ally which is still expected to see growth this year), Georgia (which was bailed out after last year’s war with Russia) and Serbia.

Most other countries in the region are faring much better, though. Poland—by far the largest economy of the new EU members—is nowhere near collapse. Unlike its central European neighbours, it is big enough not to depend chiefly on exports to the rest of the EU. By European standards, its public finances are in fairly good shape. Its debt-to-GDP ratio is below 50%. Growth will be negligible, or slightly negative, but nobody is forecasting a big decline. Some Polish firms and households have taken out foreign-currency loans—but the figure is around 30% of all private-sector lending, compared with twice that in Hungary.

The second-biggest economy, the Czech Republic, is in good shape too. Its economy may shrink by 2%, but it has a solid banking system and low debt. Its neighbour Slovakia is in better shape still: it managed to join the euro zone this year. Like Slovenia, which joined two years ago, Slovakia can enjoy the full protection of rich Europe’s currency union, rather than just the indirect benefit of being due to join it some day.

Farther afield, the picture is very different. For the poorest ex-communist economies, the problem is not financial meltdown. They lack much to melt. Their exports are raw materials, agricultural products and people. In six countries, money sent home by foreign workers counts for more than 10% of GDP (in Tajikistan and Moldova it is more than 30%). Outsiders who agonise over the Latvian lat or Hungarian forint are rarely bothered with worries about the somoni (Tajikistan), leu (Moldova) or manat (Turkmenistan).

That highlights an important problem. Outsiders tend to lump “the ex-communist world†or “eastern Europe†together, as though a shared history of totalitarian captivity was the main determinant of economic fortune, two decades after the evil empire collapsed. Though many problems are shared, the differences between the ex-communist countries are often greater than those that distinguish them from the countries of “old Europe†(see table).

They range from distant, dirt-poor despotic places to countries in the EU that are not just richer than some of the old ones, but have better credit ratings, sounder public finances and stronger public institutions. In almost any contest for good government, stability or prosperity, Slovenia (under a sort of communism until 1991) looks better than Greece, which invented democracy and was never communist.

The thirst for capital

Historical and geographical quibbles aside, what the ex-communist countries have shared over the past decade is a mighty thirst for capital. Having missed out on decades of growth and integration with the outside world, almost all (a few oddballs in Central Asia aside) are trying to catch up. Money from abroad has come in from borrowing on the bond market, from foreign direct investment or from selling shares. Most often it has come through bank loans.

At one extreme is Russia, which enjoyed huge external surpluses thanks to its wealth of raw materials. But its big companies borrowed lavishly on the strength of that, creating a potential short-term debt problem. Russian corporate borrowers have to pay back around $100 billion this year. At the other extreme lie countries such as Slovakia. They attracted billions from foreign car manufacturers, drawn by a skilled workforce, low taxes and decent roads in the heart of high-cost Europe.

Countries that relied chiefly on foreign direct investment are the least vulnerable now. The new factories may shut down. But it is harder for that capital to flee. Those that rely on foreign investors buying their bonds, such as Hungary, are the most vulnerable: their fortunes vary with every twitch of a trader’s fingers. In the middle are those that rely on lending from foreign banks to their local subsidiaries. That looked solid in the boom years, as Western banks scrambled to win market share by offering good terms to borrowers and lenders in the fastest-growing bit of Europe. It is still highly unlikely that any Western bank will pull the plug on a subsidiary anywhere—even in troubled Ukraine.

But nerves are jangling. The ex-communist countries have survived the first phase of the crisis, thanks to their own policies and some external support. The second phase, in which the rich world is turning stingier and possibly more protectionist and lenders are scurrying to safety, may be harder. The ex-communist economies must repay or roll over a whopping $400 billion-odd in short-term borrowings this year. Coupled with the lazy but easy lumping of nearly three dozen countries together, that creates the region’s biggest danger: contagion (see article). In other words, failure in one place sparks a disaster in another, even though it may be far away and have the same problem in a far more manageable form.

Contagion could happen in many ways. One is if depositors lose confidence that their savings are safe. So far, Western-owned banks have enjoyed rock-solid credibility: more so, in many cases, than governments or other public institutions. But that confidence could be undermined. If only one foreign bank pulls the rug from under one local subsidiary, leaving depositors stranded, it will cloud perceptions of banks’ reliability across the region. The most dangerous kinds of bank runs would be those in which depositors try to pull out either their foreign currency, or local currency which they would then attempt to convert into hard currency. In some countries that could overwhelm the ability of the central bank to support the financial system.

Another weak point is where shareholders take fright. If a foreign bank with big exposure to the region—Swedish, Austrian or Italian—needs to raise more capital but finds that outsiders think its loan book is too risky, what happens? The price of rescue may be that it sheds a troubled foreign subsidiary. Signs of shareholder twitchiness are growing (see chart).

For now, the most likely source of contagion is collapsing currencies. The paradox is that for countries with floating exchange rates, an orderly depreciation would in normal circumstances be a good way of cushioning an external shock, such as the slump in export markets now hitting the ex-communist economies. It stokes competitiveness and, along with lower interest rates, it lays the foundations for a return to growth. Governments with sound public finances might also consider running a looser fiscal policy to counteract the downturn.

Propping up the currency

For most of the countries in the region, such a textbook response is out of the question. Some have currency boards, or pegged exchange rates. In the Baltic states these have been the centrepiece of economic policy for more than 15 years. Abandoning them would not only bankrupt big chunks of the economy that have borrowed in euros. It would also be a huge psychological blow to public confidence in the whole idea of independent statehood. These countries have suffered the most painful part of being in the euro zone—the inability to devalue and regain competitiveness—without getting all the benefits.

Countries with floating exchange rates have a bit more room for manoeuvre. Their problem (a big one in Hungary, a lesser one in Romania and Poland) is that falling exchange rates may bankrupt the firms and households which have, in past years, taken out unwise loans in foreign currencies, chiefly euros and Swiss francs. That was, in effect, a convergence play. If you believed your country was heading for the euro zone some time in the next few years, then why not take advantage of the low interest rates there, rather than suffer the higher ones in your domestic currency?

What seemed a minor risk back then now looks painfully mistaken. For those earning forints or Polish zloty, the big swings in exchange rates in recent weeks have sent the size of both loans and repayments spiralling upwards. The zloty has dropped 28% and the forint 22% against the euro since the middle of last year. If the East Asian crisis of 1997 is any guide, these and other currencies may yet have further to fall.

This risk of a currency collapse will limit these countries’ options. So far many big central European countries have cut interest rates heavily to try to boost their economies—Poland’s central bank cut its policy rate again this week. But currency weakness will limit their room for manoeuvre. The Czech, Hungarian and Polish central banks issued a co-ordinated statement this week hinting they might intervene to support their exchange rates. But that route is tricky. Russia has blown half its reserves in a series of unsuccessful attempts to try to prop up the rouble.

Spending and tax policies would be another way of dealing with a downturn. But these are constrained, too. Those countries with a chance of joining the euro are scrambling to cut their budget deficits to get them in line with the 3% of GDP target set by the EU’s Maastricht treaty. Yet that aggravates the problem. The danger for Latvia and Ukraine is a downward spiral, where cuts in public spending damage the economy in a way that helps to entrench the deficit.

So far, the economic crisis has not translated into populist or protectionist politics. It is the east European countries that have been demanding that the rest of the EU stick by the rules of the single market. Their development over the past decades has been thanks to the free movement of capital, goods and labour. They would like a lot more of it: in a contest to subsidise industries, rich countries always win.

But that stance will not hold indefinitely if things get worse. Willem Buiter, a prominent economist, believes it is only a matter of time before some of the ex-communist countries introduce capital controls. That, in theory, would allow them to concentrate on stabilising their economies without worrying so much about the external value of their currency. If voters find the economic pain of adjustment unbearable, politicians can pass laws that will make foreign-currency borrowings repayable in local currency. That would be met with fury by the foreign banks, who would in effect see their loan books expropriated. But it could happen.

Against that background, what can be done? The east European countries are, belatedly, co-ordinating their approach within the EU, holding their own mini-summit on March 1st. They want to embarrass countries such as France for what they see as its protectionist approach to the crisis. They are supporting each other: the Czech Republic and Estonia were among those contributing to the Latvian bail-out.

But even co-ordinated local efforts are unlikely to make much difference, given the scale of the problem. The real lead, and the real money, must come from outside the region. That brings into play a slew of political problems. Having trumpeted their free-market principles in past years, and dismissed the stodgy approach of countries such as Germany and France, the new EU members from eastern Europe are now turning to old Europe in the hope that it can hurry up the flow of EU structural funds to counteract the downturn, bail out or prop up over-exposed banks in places like Austria, and stretch the rules of the European Central Bank to let it provide support to countries outside the euro zone. The case for such measures is strong, and it is in the interest of all Europe that contagion is contained. But that does not mean that it will happen.

Raivo Pommer

raimo1@hot.ee

Holland 5 krise

Wer den tagesaktuellen Zinsschwankungen entgehen möchte und sein Geld längerfristig parken kann, sollte über eine Festgeld- oder Sparbriefanlage nachdenken. Auch hier gibt es interessante Offerten. Bei einem Anlagehorizont von zwölf Monaten markiert der niederländische Neuling NIBC-Direct mit 5,25 Prozent aktuell die Bestmarke (Mindeteinlage 1.000 Euro), einen geringfügig niedrigeren Zinssatz erhalten Sparer bei der Amsterdam-Trade-Bank (5,20 Prozent, Mindesteinlage 5.000 Euro). Die Bankhäuser Credit-Europe und Yapi-Kredi verzinsen Festgeldanlagen bei einem Jahr Laufzeit mit fünf Prozent. Die Mindesteinlagen betragen hier 2.500 Euro bzw. 5.000 Euro.

Mitunter noch lukrativer können mehrjährige Anlagen sein. Allerdings erhalten Sparer derzeit nennenswert höhere Renditen nur, wenn sie ihr Geld für zwei Jahre anlegen. Laufzeiten darüber werden im Schnitt sogar schlechter verzinst. Für 24 Monate gelten folgende Zinssätze: Credit-Europe-Bank (5,50 Prozent), NIBC-Direct (5,30 Prozent) sowie Amsterdam-Trade-Bank (5,25 Prozent). Einzige Ausnahme ist die Yapi-Kredi-Bank, sie bietet Kunden den gleichen Zinssatz wie beim einjährigen Festgeld, fünf Prozent. Die Mindesteinlagen sind identisch der genannten Festgeldanlagen.

Für alle genannten Termingeldanbieter gilt die europäische Einlangensicherung holländischer Prägung, also – vorerst bis zum 6. Oktober 2009 – sind 100.000 Euro pro Person abgesichert, was beachtet werden sollte, wenn man längerfristige Anlagen erwägt. Über eine Anschlussregel

great post

I can’t agree with some of the concepts which are held here..Have u undergone any analysis..

how to fix credit score

I can’t agree with some of the concepts which are held here..Have u undergone any analysis..

how to fix credit score

I think if voters find the economic pain of adjustment unbearable, politicians can pass laws that will make foreign-currency borrowings repayable in local currency..

credit card reviews

Thank you for the information. I liked it

Raja

Too long and not relate to the origin post but I'll try to read and understand.

free credit report, free credit report

My weight was normal until I contracted what my mother said was measles for the second time when I was 5. I have been battling obesity ever since. Not even having my stomach stapled at age 20 made a difference.

Blood tests my doctor ordered said I have a slight infection indicator but that never changes from test to test. I firmly believe there is more to this to be discovered.

Yes something has to fill the fat cells I think if I understand your point. If you do not over eat your fat cells can’t increase in size.

But…. Do you assume that everyone has an identical metabolism?

If true then take 10000 people and have them eat the exact thing each day and have them do the exact same amount of exercise or no exercise. Do you think all these people will look and weigh exactly the same? If yes or if no please attempt to expand even if you are just theorizing.

Thanks.

Very nice article, thanks. I like it. kredi site

Very objectively written article. Promising research. 🙂

Pingback: Ebola Outbreak - Mad Scientist.Crazy Mom

Thanks for the great article. i really appreciate it. it will be a great guide for my notebook fiyatları thesis

Great article, thanks. I like it. En kolay kredi